Latest News

Lukfook Group Recognised as a “Happy Company” for 12 Consecutive Years

(20 March 2025) — Luk Fook Holdings (International) Limited (“Lukfook” or the “Group”) (Stock Code: 0590) is pleased to announce that the Group has once again been recognised as a “Happy Company” under the “Happiness at Work” promotional scheme, marking the Group’s 12th consecutive year of receiving this honour. This achievement not only highlights the Group’s long-standing efforts in fostering and promoting a harmonious workplace culture and caring for employees, but also reaffirms Lukfook’s ongoing commitment to creating a joyful working environment. Mr. Wong Wai Sheung, Chairman and Chief Executive Officer of the Group, said, “Lukfook has always regarded employees as the Group’s most valuable asset. Upholding the corporate mission of ‘Building a Family with Love,’ we are dedicated to fostering a joyful workplace culture and creating a diverse, equitable, and inclusive working environment. We provide career development opportunities and encourage employees to achieve a balance between work and life, enhancing their sense of belonging and well-being while driving the sustainable and steady growth of the company. Looking ahead, we will continue to work hand in hand with all our employees, growing together and striving for an even brighter future.” The “Happiness-at-Work” promotion scheme is jointly organised by the Chinese Manufacturers’ Association of Hong Kong and the Promoting Happiness Index Foundation. It aims to encourage companies to implement employee care policies and measures, fostering a joyful workplace culture and enhancing workplace happiness across different sectors in Hong Kong. The scheme also emphasises the development of corporate care, corporate wisdom, corporate resilience, and corporate motivation, promoting sustainable workplace happiness. Ms. Lai Pui Yu, Vivian, Deputy Administration and Human Resources Director of Lukfook Group, received the recognition on behalf of the Group ~End~

Lukfook Group Wins Three Awards at the 26th Hong Kong Jewellery Design Competition

(10 March 2025) — Luk Fook Holdings (International) Limited (“Lukfook” or the “Group”) (Stock Code: 0590) is pleased to announce that the Group’s jewellery design team has won three prestigious awards, including the “Best of Show Award (Open Group)”, the “Craftsmanship and Technology Award” and the “Merit Award (Open Group)” for the design pieces “Romance Classics” and “Shining Stars” at the 26th “Hong Kong Jewellery Design Competition”. Mr. Wong Wai Sheung, Chairman and Chief Executive Officer of the Group, said, “This award once again affirms the strength of the Group’s jewellery design team. With leading trend sensibility, they have created innovative, unique, fashionable, exquisite, and finely crafted jewellery pieces. We combine innovative design with exquisite craftsmanship, meticulously crafting every piece of jewellery with a sincere attitude, interpreting the definition of 'beauty' through its creations. In future, the Group will invest more resources to nurture outstanding design talent, continue the legacy of craftsmanship, and actively expand international presence, striving to bring more distinctive and unique jewellery products to customers.” The 26th “Hong Kong Jewellery Design Competition”, with the theme “Lasting Brilliance”, is jointly organised by the Hong Kong Trade Development Council, The Jewellers’ and Goldsmiths’ Association of Hong Kong Limited, the Hong Kong Jewellery Jade Manufactures Association, the Hong Kong Jewelry Manufacturers’ Association and the Diamond Federation of Hong Kong, China Ltd, with the aim of enhancing the design and quality of Hong Kong-made jewellery, encouraging creativity, and showcasing Hong Kong’s high-quality jewellery designs. Winning piece of “Best of Show Award (Open Group)” and “Craftsmanship and Technology Award”: Title: Romance Classics Designer: Mr. Tse Ka Wing ─ Senior Jewellery Designer Design concept: Jewellery and renowned painting share an inseparable relationship and the same origin. The designer drew inspiration from the elements of Impressionist painter Claude Monet's "Water Lilies", and used the art of jewellery to perfectly showcase the romance and elegant nature of this classic masterpiece. Winning piece of “Merit Award (Open Group)”: Title: Shining Stars Designer: Mr. Au Kwok Man, Kenny ─ Jewellery Design Director Design concept: Every star in the night sky shines with its unique brilliance, just as every important moment in life is worthy of being remembered. Jewellery can show in multiple ways - a ring can turn into a brooch, a pendant, a necklace or a hair accessory to suit the wearer's needs for different occasions. Mr. Au Kwok Man, Kenny, Jewellery Design Director of Lukfook Group (1st right), and Mr. Tse Ka Wing, Senior Jewellery Designer of the Group (1st left), accept the prestigious award presented by the organiser ~ End ~

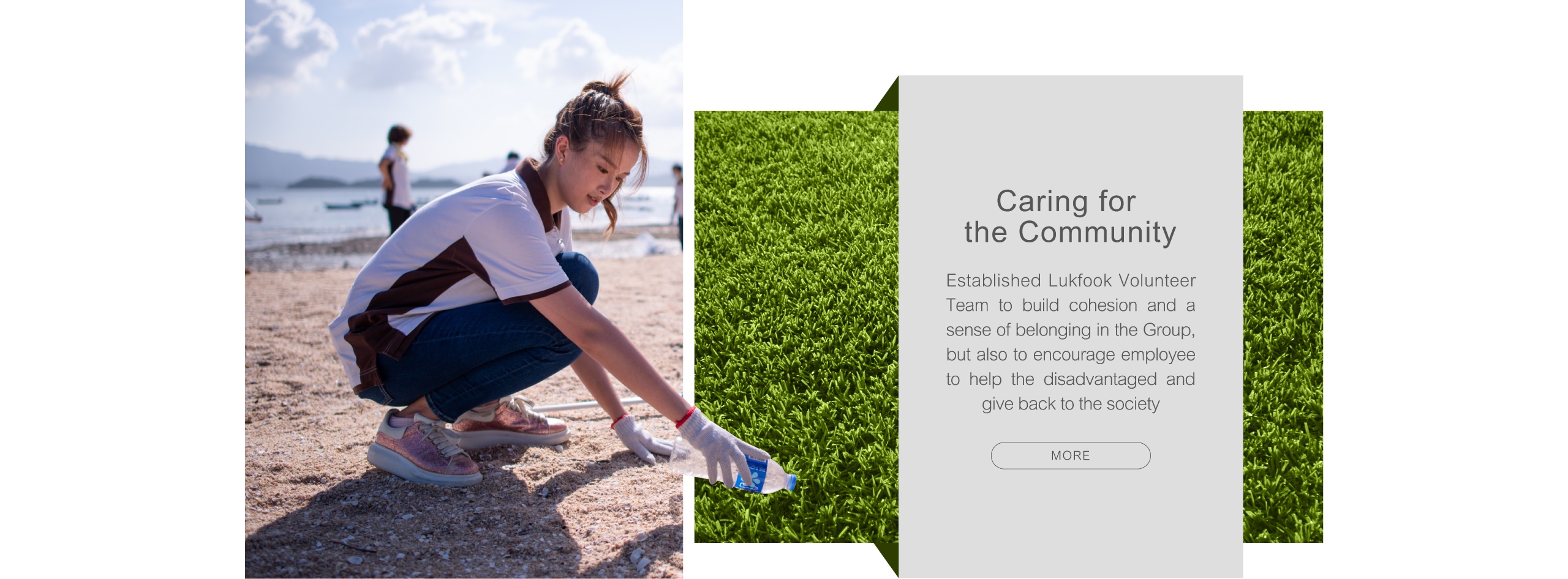

Lukfook Group Fully Supported The “2024/2025 Hong Kong and Kowloon Walk for Millions”

(28 January 2025) — Luk Fook Holdings (International) Limited (“Lukfook” or the “Group”) (Stock Code: 0590) has long been committed to promoting the development of public welfare. This year, the Group once again sponsored the “2024/2025 Hong Kong and Kowloon Walk for Millions” organised by The Community Chest of Hong Kong. The “Lukfook Volunteer Team” along with employees from 3DG Holdings (stock code: 2882), actively participated in the charitable fundraising activity, taking concrete action to fulfill social responsibility. Mr. Wong Wai Sheung, Chairman and Chief Executive Officer of the Group, said, “The Group has enthusiastically supported the ‘Walk for Millions’ charity fundraising event for 14 consecutive years. Over the years, we have insisted on the parallel development of long-term business growth and social welfare, encouraging our employees to actively engage in charitable activities. This approach helps to unite greater efforts in supporting meaningful causes and providing tangible assistance to those in need within the community. We look forward to carrying forward our corporate culture of ‘Lukfook Family’, encouraging more enterprises and citizens to love and inspire each other, contributing together to building a harmonious society in Hong Kong.” This year’s “Hong Kong Kowloon Walk for Millions” attracted over 8,000 donors, forming more than 100 walking teams and individual participants. All funds raised will be fully allocated to support 24 Community Chest member organisations that provide family and child welfare services, helping more families and children in need improve their lives and bringing greater care and warmth to Hong Kong society. Employees and their families walked together for charitable giving in the “Hong Kong Kowloon Walk for Millions” ~End~